Press Release

November 15, 2024

SBI Sumishin Net Bank, Ltd.

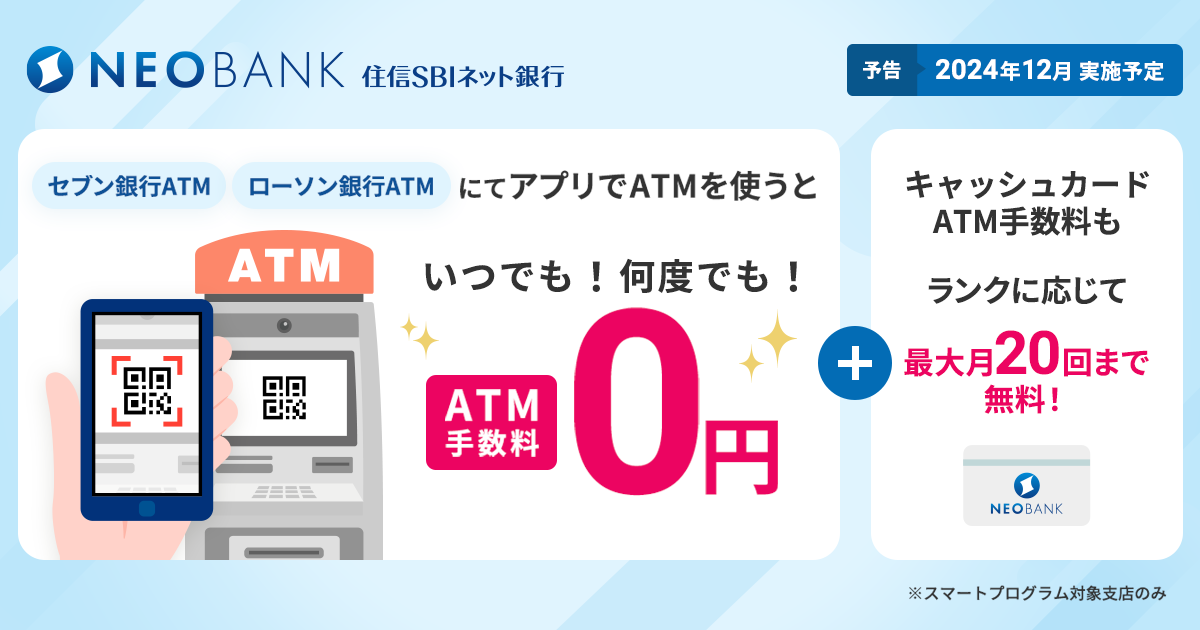

SBI Sumishin Net Bank Enters a New Era of Zero ATM Fees

~Completely free of charge for using ATM with the app + free of charge up to a certain number of times even if you use a cash card~

SBI Sumishin Net Bank, Ltd. (Head Office: Minato-ku,Tokyo; President & CEO: Noriaki Maruyama; henceforth referred to as “SSNB”) will revise its ATM fees from Sunday, December 1, 2024 and will make ATM fees completely waiver for individual customers who use branches eligible for the Smart Program※1 at any time and as many times as they want.

In addition, we would like to inform you that we have changed some of the revisions to the ATM fees when using cash cards※2 so that you can use them free of charge up to a certain number of times according to your SmaPro Rank.

Service Image Diagram

What is "ATM with the app"?

"ATM with the app" is a function that allows you to deposit and withdraw cash from ATMs of Seven Bank and Lawson Bank nationwide using a smartphone app instead of a cash card.You don't need a cash card with just one smartphone, so you can rest assured when you forget your wallet.

Revision of ATM fees when using "ATM with the app"

Until now, the number of times you can use an ATM for free was determined according to your rank in the Smart Program, but from December 1, 2024 (Sunday), if you use an ATM at an ATM with the app, you will be free of ATM fees at any time and as many times as you want, regardless of your rank.

| ATM | 現行 | 2024年12月1日(日)~ |

|---|---|---|

|

一定回数まで無料

|

何度でも |

Fee Revision Details

ATM fees when using cash cards (change)

On Tuesday, August 27, 2024, we announced a revision of ATM fees for cash card use due to the completely free ATM fee for "ATM with the app", but even when using a cash card, the usage fee will be waived up to a certain number of times according to the SmaPro Rank as follows.

|

入出金 ※「アプリでATM」の利用回数は含まれません。 |

|

|---|---|

|

ランク4

|

月20回

|

|

ランク3

|

月10回

|

|

ランク2

|

月5回

|

|

ランク1

|

月2回

|

Number of commission-free cycles by rank

Revision of ATM fees when using cash cards

From Sunday, December 1, 2024, the ATM fee when using a cash card when the number of free times exceeds the number of times according to the Smaplo Rank will be revised as follows.

| ATM | 現行 | 2024年12月1日(日)~ | ||

|---|---|---|---|---|

| お預入れ | お引出し | お預入れ | お引出し | |

|

110円(税込) |

165円(税込) | |||

| 165円(税込) | ||||

| 165円(税込) | ||||

| 330円(税込) | ||||

| 110円(税込)※3 | ||||

| 取扱いなし | 取扱いなし | 110円(税込)※4 | ||

List of Revised ATM Fees

Eligible Branches and Customers

Individual customers using the following branches are eligible.

ICHIGO branch (101)

BUDOU branch (102)

MIKAN branch (103)

REMON branch (104)

RINGO branch (105)

BANANA branch (107)

MERON branch (108)

KIUI branch (109)

TSUTSUJI branch (202)

Iruka branch (207)

KUJIRA branch (403)

- ※ 1 The Smart Program is a preferential program of SSNB that allows you to receive benefits such as free ATM and transfer fees and point earnings depending on the use of products and services.

- ※ 2 Cash cards include cash cards with debits.

- ※ 3 It is scheduled to be revised by the end of FY2025.

- ※ 4 We plan to discontinue this in the future.(To be announced separately at a later date)

About SBI Sumishin Net Bank

SBI Sumishin Net Bank (“SSNB”) is an online bank that was founded in 2007 and became the first Japanese internet bank to be listed on the Tokyo Stock Exchange Standard Market in March 2023. By leveraging the most advanced technology solutions, SSNB offers safe, secure and convenient banking experience to its customers.

In the digital bank business, SSNB has now over 7 million customer accounts with over 9 trillion yen (*1) in deposits. It consistently ranks high in customer satisfaction by recognizing individual needs of different lifestyles and life stages as well as by offering a well-designed user interface and experience.

Its mortgage business, which has built on a unique business model, is the largest among Japanese banks in terms of the amount of newly originated mortgage loans (*2).

SSNB’s NEOBANK® is a full-service BaaS (banking as a service) product offering that enables its brand partners to offer a full range of banking services to their customers. As a pioneer in the sector, it boasts a number of BaaS partnerships with Japan’s leading brands and businesses.

SSNB is vigorously engaged in non-financial activities as well including data initiatives and carbon credit trading in an endeavor to balance business growth with social responsibility.

Moving forward, SSNB will remain committed to embracing corporate social responsibility and sustainable growth as a fintech that goes beyond banking services to realize a society where prosperity and abundance circulate driven by the power of technology and a spirit of fairness.

To learn more about SBI Sumishin Net Bank, please visit: www.netbk.co.jp/contents/company/en/

(*1) The number of deposit accounts is as of February 7, 2024, and the balance of deposits is as of December 11, 2023.

(*2) This statement is base on our research as of March 31, 2023, using data disclosed by multiple domestic banks including Resona Holdings, Sumitomo Mitsui Financial Group, Sumitomo Mitsui Trust Holdings, and Mizuho Financial Group, as well as our own.

(*3) NEOBANK® is a registered trademark of SBI Sumishin Net Bank. The Registered trademark number is 5953666.

Contact

For further information about this press release, please contact:

SBI Sumishin Net Bank, Public Relations

ir_csr_sdgs@netbk.co.jp

Note: This content has been translated from the Japanese original using artificial intelligence (AI) or machine translation technology for reference purposes only.

In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail.